He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, https://www.adprun.net/ a big 4 accountancy firm, and holds a degree from Loughborough University. The next line shows the headings used for each of the ledger accounting transaction entries.

Best accounting software to view your general ledger

This is basically a subset of the general ledger and focuses on the penny your company owes to its suppliers. GL codes show essential information, including debit or credit by location. In this case, 5 represents expense transactions, 53 would be operating supplies, 531 is federal supplies, and 5311 refers to office supplies. Now let’s move on to talk about debits vs. credits and how they work in an accounting system. Liabilities are current or future financial debts the business has to pay. Current liabilities can include things like employee salaries and taxes, and future liabilities can include things like bank loans or lines of credit, and mortgages or leases.

Link to Balance Sheet and Income Statement

You may include individual assets and accounts like accounts payable and receivable, liabilities, inventory, and investments. This information is used to prepare financial reports, monitor finances, track cash flow, and prevent accounting errors or fraud. Double-entry transactions, called “journal entries,” are posted in two columns, with debit entries on the left and credit entries on the right, and the total of all debit and credit entries must balance. By comparing the total debits and credits, a business can quickly identify if there are any errors or imbalances in their accounting records. This reconciliation process ensures the integrity of the general ledger and the financial reports generated from it.

Create your own general ledger with a template

- Daily transactions and journal entries are recorded directly to the general ledger with a credit and a debit for each entry.

- Sub-ledgers are like specialized branches of the general ledger, focusing on specific accounts or business functions.

- Now, each of your transactions follows a procedure before they are represented in the final books of accounts.

- These detailed entries tell you the who, the what, the when, the where, and the why—leaving no room for confusion, thus creating clearer transaction explanations.

- We discuss the process of balancing the account in our post on balancing off accounts.

Thanks to the neatly summarized data in the general ledger, BILL’s AP automation software. The general ledger paints a clear financial picture of your company with profitability, liquidity, liabilities—you name it—all to help you better manage your finances. The general ledger follows the “T format,” sometimes referred to as “T-accounts,” with the left side depicting debit and right side credit. A company should also regularly review and update its general ledger, even when that process does not rise to the level of a reconciliation. Accounting software can be a game-changer in this regard since it can streamline the process so general ledger reviews can be performed frequently.

Want More Helpful Articles About Running a Business?

By now, you would have known that a general ledger is a detailed record of all your financial transactions and account balances. Regarding financial management, a general ledger template can be your ultimate secret ingredient that solves most of your accounting problems. The set of 3-financial statements is the backbone of accounting, as discussed in our Accounting Fundamentals Course.

Double-Entry Bookkeeping

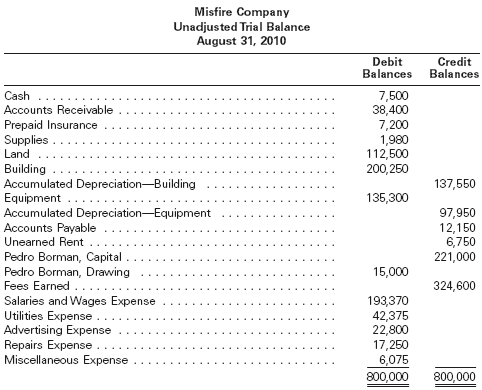

Also, it is the primary source for generating the company’s trial balance and financial statements. The ledger’s accuracy is validated by a trial balance, which confirms that the sum of all debit accounts is equal to the sum of all credit accounts. A business’ financial transactions are first recorded in a general journal. From there, the specific amounts are posted into https://www.quick-bookkeeping.net/book-value-per-share-bvps-overview-formula-example/ the correct accounts within the general ledger. Sometimes referred to as a book of original entry, the general journal lists all financial transactions of a business, and the general ledger organizes and balances transactions. Today, most accountants and bookkeepers use accounting software rather than maintaining separate journals for different types of transactions.

Likewise, the revenue and expense accounts give an accurate view of the incomes earned or the expenses incurred. Thus, these details come in handy as you do not have to look for invoices or bank statements at the time of filing tax returns. Thus, such a record helps you days sales of inventory – dsi definition in tracking various transactions related to specific account heads. Further, it also helps in speeding up the process of preparing books of accounts. As a document, the trial balance exists outside of your general ledger—but it is not a stand-alone financial report.

The general journal is where transactions are first recorded, providing a chronological record of all financial activities. Each transaction is documented with details such as the date, description, and amounts involved. This chronological order allows for a clear and accurate representation of the sequence of events. It ensures accuracy and integrity in financial recording by requiring each transaction to have an equal and opposite effect on different accounts.

These help enterprises record information about purchases, sales, and other transactions. A general ledger is a company’s financial command center, where all the penny that comes in and goes out is recorded thoroughly. Frankly, from purchases to bill payments, people consider it more as the heartbeat of a business’ financial operations. A ledger is often referred to as the book of second entry because business events are first recorded in journals. After the journals are complete for the period, the account summaries are posted to the ledger. Consider the following example where a company receives a $1,000 payment from a client for its services.

This template gives you everything you need to set up a simple, single-entry accounting system for your business. If your business is busy, and you find it hard to keep your books organized with this template, it may be time to consider double-entry bookkeeping. And your bookkeeper can always walk you through your GL if you have questions. Just know that when your bookkeeper prepares financial statements for you, they’re pulling from the general ledger. These codes are sometimes called an “account number.” In this example, all puppet-making-material purchases are coded 205, all sales revenue is coded 103, and so on.

All plans include invoicing, online payment capability, project budgets, and solid reporting options. Though reporting options are fairly basic in FreshBooks, reporting choices have improved in recent years, with both dashboard and insight reports available. In fact, if you want to see how much money your current bank account holds, or why your printing expense account is so high, you would turn to your general ledger first. So, dive into the world of general ledgers and unlock the power of accurate financial management.